When a manufacturer requires call reports from a manufacturers’ representative, does he or she jeopardize the independent contractor status of the manufacturers’ representative and risk becoming responsible for the employer’s share of social security tax and the federal unemployment tax (FUTA) on commission payments?

This is a frequent and sometimes contentious topic between manufacturers’ representatives and their principals, so MANA is very pleased to have permission to present this very articulate treatment of the topic from the Manufacturers’ Agents Association for the Foodservice Industry (MAFSI) as a MANA guest blog.

Special thanks to Alison Cody, MAFSI’s Executive Director, for her permission to present this material. More about MAFSI at www.mafsi.org.

MAFSI Statement on Call Reports

Call reports have the potential to jeopardize the reps’ status as an independent contractor. In most instances, the question of whether a salesperson is an employee or an independent contractor arises as a result of an IRS audit.

According to recent news reports, the Internal Revenue Service will look at the issue of independent contractors in audits of 6,000 randomly chosen companies during the next three years.

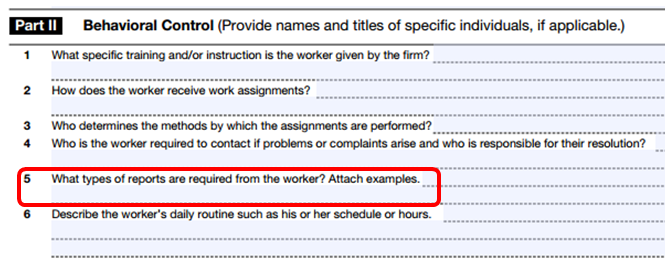

Meanwhile, proposals on Capitol Hill would give the Department of Labor more resources to ensure that companies classify their workers correctly. They would also change a safe harbor in the tax code that has enabled some companies to continue their practice of misclassifying workers. The link below is the form which the IRS uses when determining worker status.

While MAFSI realizes the reporting of significant opportunities or problems with key accounts must exist between rep and manufacturer, the IRS states the following concerning independent contractors, “The general rule is that an individual is an independent contractor if you, the person for whom the services are performed, have the right to control or direct only the result of the work and not the means and methods of accomplishing the result.”

MAFSI contacted Atlanta tax attorney, Calvin Bomar of Bomar & Phipps, LLC who responded, “Call reports are a factor that will weigh against the Taxpayer when the IRS is evaluating the behavioral control, financial control and relationship of the parties.

In the event that the manufacturers’ representative is reclassified as an employee, instead of an independent contractor, it can have several negative consequences for both the manufacturer and the representative.

The manufacturer can become liable for the income and social security taxes that are required to be withheld from employees, the employer’s share of social security tax and the federal unemployment tax (FUTA).

This can lead to an IRS challenge of business expenses claimed by the representative. It can also harm the future relationship between the manufacturer and representative, since reclassification will generally result in the IRS requiring the manufacturer to use employees to perform the duties that were previously completed by the independent contractor (representative).”

An agreement setting forth that the worker is an independent contractor is recommended; however, any agreement, no matter how well drafted and explained to each party and signed, will not change the results if a person is held to be an employee under the facts and circumstances.

The laws surrounding the employee versus independent contractor issues are extremely complex and many states may have additional rules or laws regarding independent contractor status. MAFSI recommends that all members consult with their tax professional for further clarification on these issues.

In addition, we encourage reps and manufacturers to have meaningful dialogue on all partnership issues including reports. Both parties should review these types of requests jointly to determine if they are a productive use of the reps’ and manufacturers’ selling time.